A loan pipeline software application is an excellent choice in order to streamline the administration of your loan portfolio. Not only does it save the time and energy of any company dealing with loan processing, but it also helps increase the accuracy of the process across the board and ensures that transactions are recorded correctly and safely. In addition, using technology to automate certain processes can dramatically reduce the manual labor required for the onboarding and approval process for loans, leading to efficiencies that benefit lenders as well as those who borrow.

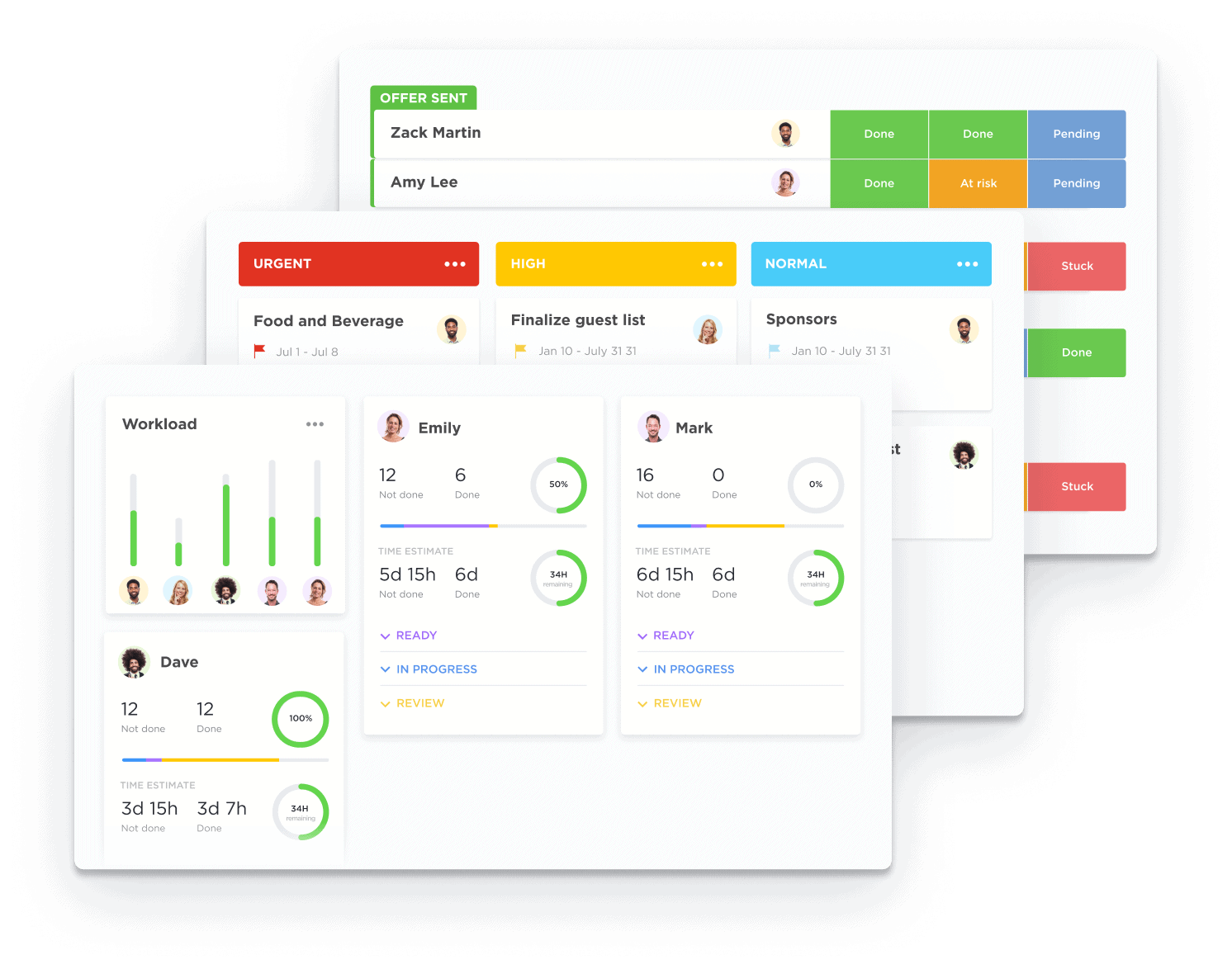

Automated management and tracking software allow you to track and manage loan transactions from origination until the time of closing. The automatic generation of documents and reports improves efficiency and accuracy throughout the duration of a company, reducing time and energy. Technology can also automate specific procedures for onboarding, which decreases the need for manual labor on both the side of the lender and the borrower. The loan pipeline software can be particularly beneficial for increasing the efficiency of liquidity management. It gives users access to live collaboration features and connects the ability to report on data. This technology can also be used to enhance customer service. Businesses can employ it to manage customer relations using friendly customer support tools and automated processes.

Loan agents depend on good customer relations and constant communication to get their job accomplished. If lenders do not have a CRM, they may have trouble keeping all of their contacts, related documents, and other details. A CRM lets you quickly access information about customers and notify them of any changes. It is also possible to monitor loan progress, and track applications to streamline your workflow creating reports and numerous other features. A CRM can help loan professionals streamline their processes, save time and decrease the hassle. A CRM can be an investment worth it for loan brokers who wish to effectively manage clients and even close loans.

The software to manage the loan pipeline is an important tool for institutions of finance. It allows you to place and send loan orders. The software reduces manual processing and improves accuracy within the loan pipeline. These benefits extend beyond efficiency. They also allow for improved customer service. Customers are provided with live updates on loan status and can be assured that their loans are being executed punctually. This software can reduce operating costs since errors made by hand are reduced and less staff is required to finish tasks. The software can be modified to meet the company’s reporting requirements or communications requirements. Businesses can rest assured that their transactions are protected against unauthorized access.

Increase the efficiency of your business

Software that automates the management of your loan pipeline is ideal to make your company more efficient. It lets you track how you organize and manage the entire loan process from beginning to finish quickly and easily. Automating the process saves time, and money and decreases manual effort. Loan pipeline software can help you improve customer experience by improving loan application processes and improving decision-making speed. In addition, it assists to reduce human error and can provide transparency into every aspect of the loan life cycle. This type of software can assist you in getting an advantage in the marketplace.

Simple and affordable

Loan Pipeline Software offers affordable and easy solutions to assist you in managing your loan servicing. This program includes all of the tools that you need to monitor and control your borrower’s loan data as well as payments and other related documents. Loan Pipeline is especially useful for companies that face huge volumes of information since it allows multiple users to collaborate with each other across different places and offers flexible access whenever needed. Loan Pipeline Security features provide the security of confidential information from unauthorized third-party access. Loan Pipeline is an excellent choice for people who want an affordable and cost-effective solution, but who don’t want to compromise on security or quality.

Your business can run from any location

The way we run our businesses has changed dramatically thanks to loan pipeline software. You can also run our business remotely. The technology of loan trackers lets us monitor loans and projects from a distance and makes it easier to manage a company no matter where you are located in the world. Loan software offers real-time data on potential and existing customers , as well as a report on application development and performance. You will gain crucial insights and data about your clients through loan software. This allows you to get information that is not easy to locate manually within an office environment. For entrepreneurs who want to be mobile and flexible no matter where they live and work, loan tracking is a great resource. It is an integral part of any loan management program.

To know more, click loan tracking software